What Is 529 Contribution Limit For 2025. Each state sets a maximum 529 plan contribution limit per beneficiary. Since each donor can contribute up to $18,000 per.

If the contribution is below a certain limit each year, you won’t have to notify the irs of it. Here are some of the best 529 college savings plans for tax benefits and how to choose a 529 plan in 2025.

Starting in 2025 — thanks to “ secure 2.0 ,” a slew of measures affecting retirement savers — families can roll unused money from 529 plans over to roth.

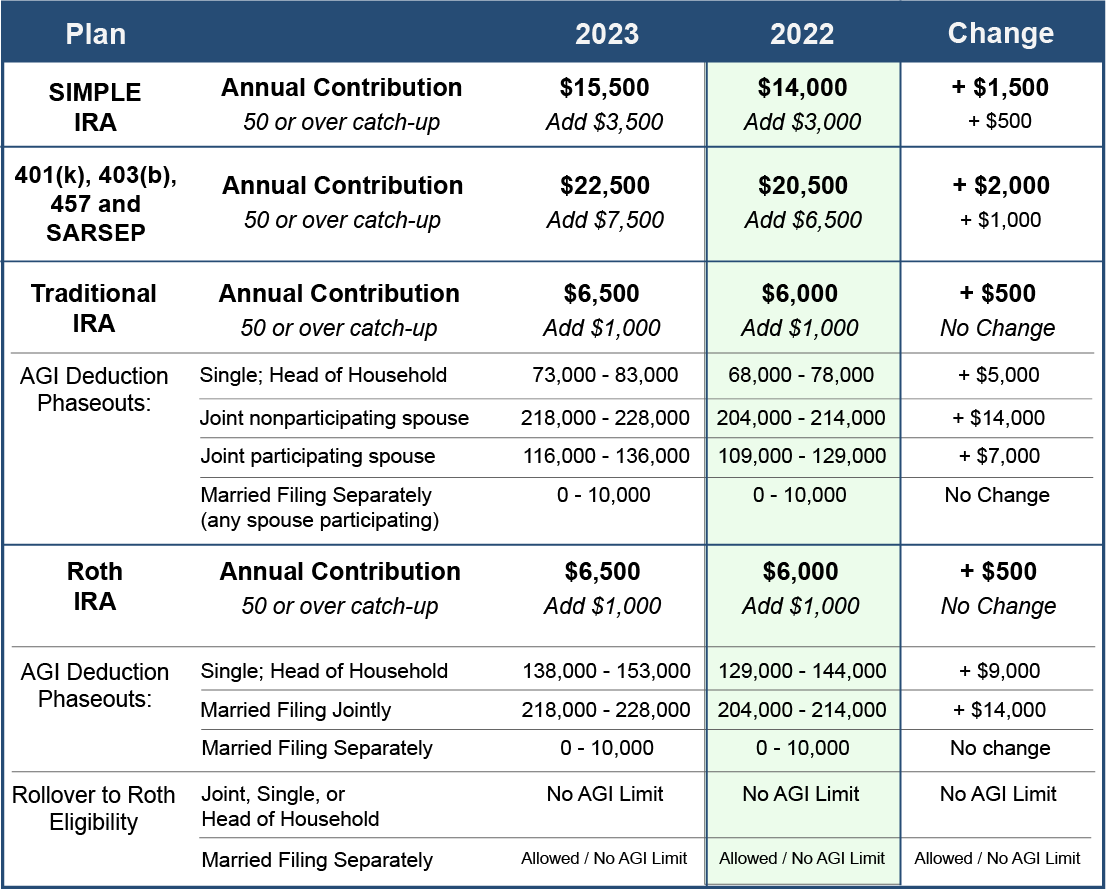

Plan Your 2025 Retirement Contributions Velisa Bookkeeping Services LLC, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older. 529 contribution limits for 2025:

Max 529 Contribution Limits for 2025 What You Should Contribute, That means an individual can contribute up to $90,000 in a single year to a particular 529 plan in 2025. New fafsa rules opened up a 'grandparent loophole' that boosts 529 plans.

529 Plan Contribution Limits Rise In 2025, Here are some of the best 529 college savings plans for tax benefits and how to choose a 529 plan in 2025. You also need to do this strategically as you cannot rollover an amount greater than the annual roth contribution amount, which in 2025 is $7,000.

529 Plan Contribution Limits Rise In 2025 YouTube, The estimated average payment will go up by $59, to $1,907 from $1,848. Starting in 2025, 529 account owners can.

Limit On 529 Contrib … Cleo Mellie, The best custodial accounts are. The estimated average payment will go up by $59, to $1,907 from $1,848.

IRA Contribution Limits And Limits For 2025 And 2025 BlockBitBank, Additionally, rollovers are subject to the maximum contribution limit for roth iras, up to $7,000 for investors 50 and younger for 2025. 3 up to $90,000 per beneficiary for 2025, assuming no other gifts to that beneficiary during the 5 year period, starting with the year in which the frontloaded 529.

529 Plan Contribution Limits How to plan, 529 plan, Saving for college, Since each donor can contribute up to $18,000 per. If the contribution is below a certain limit each year, you won’t have to notify the irs of it.

Must Know 2025 Roth Ira Limits Article 2025 BGH, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans. The 529 education savings plan got a couple of big upgrades in 2025 as a tool to save.

nj 529 plan tax benefits Tiffaney Bernal, Additionally, rollovers are subject to the maximum contribution limit for roth iras, up to $7,000 for investors 50 and younger for 2025. Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, 529 contribution limits for 2025: Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

If you make a monthly contribution of $200 for 18 years, for example, with an average gain of 7% a year, you’ll have about $84,000 when the child is ready to enroll in.